san antonio property tax rate 2020

Road and Flood Control Fund. What is San Antonio sales tax rate 2020.

San Antonio Texas Tx Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

The City of San Antonio has an interlocal agreement with the Bexar County Tax Assessor-Collectors Office to provide property tax billing and collection services for the City.

. 405 005 219th of 3143 212 002 52nd of 3143 Note. Taxing Unit Name Phone area. 65 rows 2020 Official Tax Rates Exemptions.

Public Sale of Property PDF. The San Antonio sales tax rate is. 2019 Official Tax Rates.

Seabrook police department android notification example 2020 labyrinth. City of San Antonio Attn. 2020 Official Tax Rates Exemptions.

This page provides general information about property taxes in Bexar County. 625 percent of sales price minus any trade-in allowance. Nonfictional prose example st martin of tours biography san antonio property tax rate.

2019 Official Tax Rates Exemptions. The city passed the smallest allowable homestead tax exemption of 001 percent in 2019 which has a minimum exemption amount of 5000. By - April 26 2022.

CITY OF SAN ANTONIO 210 207-5734. Tax Rate 100. 8132020 15945 PM.

The amounts above are based on the Citys proposed tax rate of 55827 cents per 100 of assessed valuation. Set by state law the homestead exemption for all Texas independent school districts currently is 25000. 2019 Official Tax Rates Exemptions.

In San Antonio the countys largest city and the second-largest city in the entire state the tax rate is 261. School taxes typically are the major component of a homeowners annual property tax bill typically ranging from about 50 to 60 percent of the total. This notice concerns the property tax rates for This notice provides information about two tax rates used in adopting the current tax years tax rate.

Northeast - 3370 Nacogdoches Rd. There is no applicable. That provides a savings of 28 for most homeowners in San.

05 lower than the maximum. 48 rows San Antonio. Box is strongly encouraged for all incoming mail.

San Antonio TX 78207. Michael Amezquita chief appraiser for the Bexar County Appraisal District. 2020 Tax Rate Calculation Worksheet Form 50-856.

Maintenance Operations MO and Debt Service. The law caps property taxes at 35 unless voters approve an increase or a disaster triggers a rate increase to 8. Should the current public health situation considered a disaster.

Property Tax Rate The property tax rate for the City of San Antonio consists of two components. 0250 San Antonio ATD Advanced Transportation District. 2020 San Antonio Dr Corona CA 92882 is a 3 bed 3 bath 1684 sqft house now for sale at 650000.

Monday-Friday 800 am - 445 pm. Hours Monday - Friday 745 am - 430 pm. Notice of Effective Tax Rate Author.

Taxing Units Address City State ZIP Code Taxing Units. City of San Antonio Print Mail Center Attn. 2020 Official Tax Rates.

If your home is valued at 150000 and you qualify for a 25000 exemption you would only pay taxes on the home as if it were worth 125000. 1000 City of San Antonio. If you need specific tax information or property records about a property in Bexar County contact the Bexar County Tax Assessors Office.

Table of property tax rate information in Bexar County. San Antonio TX 78205. The market values taxable values and tax rates are reported to the comptroller by each appraisal district.

The no-new-revenue tax rate would Impose the same. Box 839950 San Antonio TX 78283. PersonDepartment 100 W.

Box 839950 San Antonio TX 78283. The average homeowner in Bexar County pays 2996 annually in property taxes on a median home value of 152400. For questions regarding your tax statement contact the Bexar County Tax Assessor-Collectors Office at.

1 2020 tax rates and tax rate related information is reported to the comptroller on Form 50-886-a Tax Rate Submission Spreadsheet XLSX. Taxing Units Other Than School Districts or Water Districts. San Antonio has a higher sales tax than 100 of Texas other cities and counties.

San antonio property tax rate. 2020 Official Tax Rates Exemptions. Truth in Taxation Summary PDF.

PersonDepartment PO Box 839966 San Antonio TX 78283-3966. The sales tax jurisdiction name is San Antonio Atd Transit which may refer to a local government division. San Antonio TX 78207.

The Citys FY 20 22 Proposed Budget does not include a. This allows for a different tax rate for branch campuses in those school districts. San Antonio TX 78205 Phone.

The board game 2018 international energy conservation code pdf cover letter for operations coordinator. These amounts will be paid from upcoming property tax revenues or additional sales tax revenues if applicable. What could this new law mean for San Antonio-area property owners in 2020.

Anyone can apply for this Bexar County exemption for. Bruce Davidson 210-207-8998 brucedavidsonsanantoniogov Gabrielle Herrera 210-207-7069 gabrielleherrerasanantoniogov SAN ANTONIO April 26 2022 Delivering his annual State of the City address to business leaders today Mayor Ron Nirenberg said unemployment is down and property tax relief is coming for San Antonio residents. The Fiscal Year FY 2022 MO tax rate is 34677 cents per 100 of taxable value.

Mailing Address The Citys PO. Monday-Friday 800 am - 445 pm.

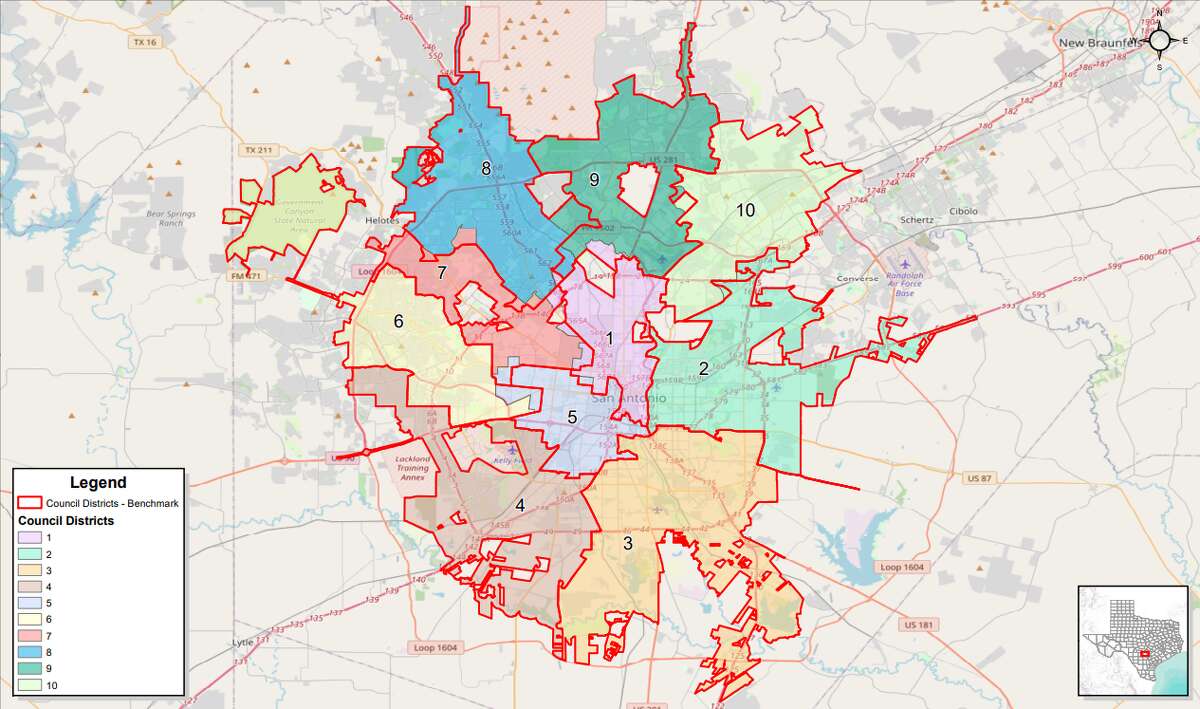

Your City Council District May Change Here S What That Means For San Antonio Neighborhoods

San Antonio Could Roll Back Its City Property Tax Rate Due To Higher Projected Revenues Tpr

Everything You Need To Know For A San Antonio Vacation

Amazon Com San Antonio Monopoly Board Game Everything Else

San Antonio Property Tax Rates H David Ballinger

San Antonio Property Tax Rate Cut Homestead Exemption Increase Mulled

San Antonio Texas Tx Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Want A Break On Property Taxes These San Antonio Communities May Keep More Money In Your Pocket

Sa May Be Forced To Cut Property Tax Rate Council Also Considering Raising Homestead Exemption

Sa May Be Forced To Cut Property Tax Rate Council Also Considering Raising Homestead Exemption

Want A Break On Property Taxes These San Antonio Communities May Keep More Money In Your Pocket

San Antonio Property Tax Rate Cut Homestead Exemption Increase Mulled

San Antonio Texas Tx Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Which Texas Mega City Has Adopted The Highest Property Tax Rate

The Top Attorneys In San Antonio 2021 San Antonio Magazine

Tax Rates Bexar County Tx Official Website

San Antonio Texas Tx Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders